The West’s Premier Banking Experience, now in Arizona!

Umpqua Bank serves businesses and families throughout the West through a deeply connected family of financial brands focused on combining premier banking services with a community bank mindset. As a premier regional bank with over $50 billion in assets, we combine the resources, sophistication, and expertise of a national bank with our commitment to deliver personalized service at scale.

By leveraging these strengths, we’re able to deliver our trademark brand of relationship-based service. We take the time to understand each of our client’s and community’s unique needs, providing local expertise backed by our regional support network to help them prosper.

Meet Our Local Branch Team

Meet Our Commercial Banking Team

-

Read bio

Jonathan Akongo

Client Solutions Manager -

-

Read bio

Alex Greene

Middle Market Underwriter -

Read bio

Bryan Marscovetra

Middle Market Relationship Manager -

Read bio

Mike Paduone

TM Consultant -

Read bio

Alain Pelanne

Middle Market Relationship Manager -

Read bio

Dan Slocum

Middle Market Relationship Manager -

Read bio

Ryan Summers

Middle Market Team Lead

Meet Our HOA & Healthcare Banking Teams

David Rinkes

Healthcare Business Development Officer

Strength in Numbers

![]()

$52B in Assets

![]()

$42B in Deposits

![]()

$37B in Loans

mobile title

desktop title

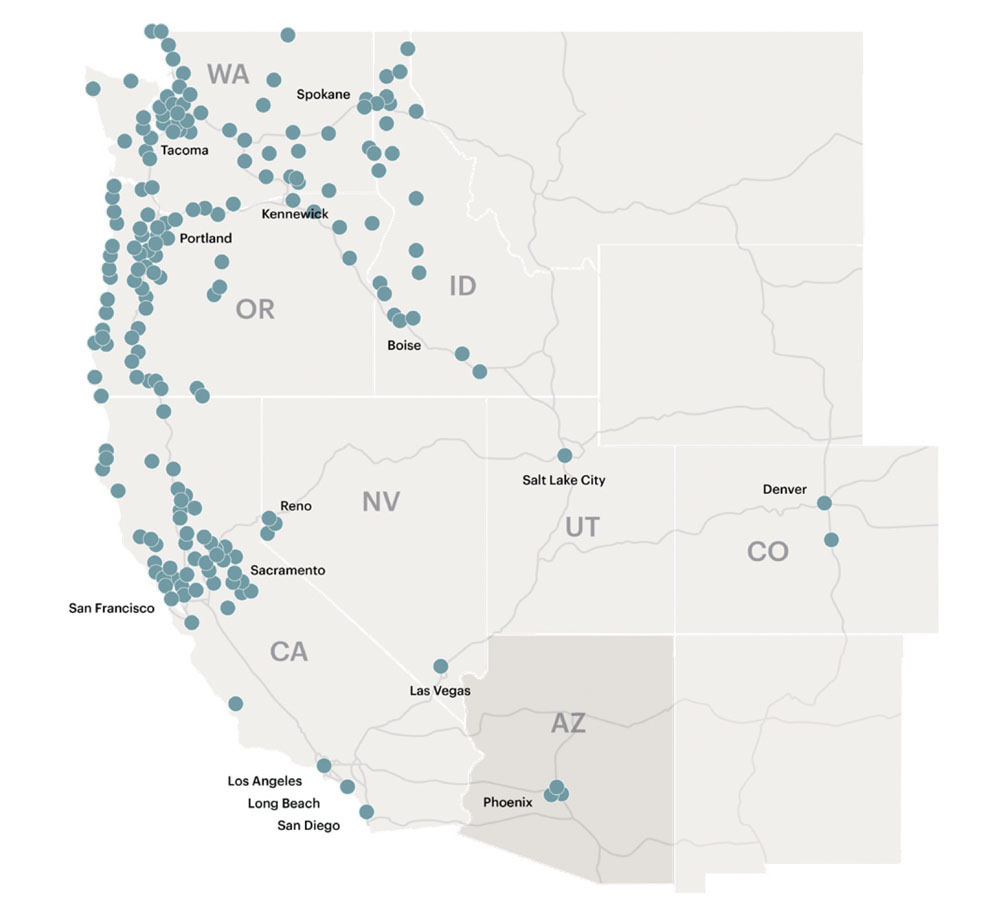

Nearly 300 locations in our eight-state Western footprint.

-

Phoenix Branch – Now Open

10201 S 51st St, Ste A105,

Phoenix, AZ 85044

(602) 735-3755 -

Scottsdale Branch – Now Open

8501 N Scottsdale Rd, Ste 190,

Scottsdale, AZ 85253

(602) 308-2133 -

Mesa Branch – Coming Soon

Your Business is Our Focus

Business Banking Services

Working Capital

- Revolving lines of credit

- Asset-based lending (ABL)

- Trade-cycle finance

Term & Equipment

- Debt

- Leasing

- CRE

- Owner-occupied

- Non-owner occupied

Treasury Management

- Working capital optimization & automation

- Fraud protection

- Commercial card programs

- Integrated payments

- Merchant card services

- Insured Cash Sweep and CDARS

International Banking

- Letters of credit

- Export-import and trade credit

- Foreign exchange solutions

Wealth Management

- Private banking

- Trust & estate planning2

- Succession planning

- Financial advisory services1

- Insurance

Debt Capital Markets

- Interest rate swaps

- Syndications

Specialty Finance

- Healthcare lending

- Warehousing lines of credit

- Acquisition finance

- Sponsor-backed lending

- Leveraged ESOP & divestiture

- Municipality finance

- Non-profit & private school finance